Weekly Market Update: 19 November 2025

Newsletters

Weekly Market Update: 18 February 2026

Newsletters

Weekly Market Update: 11 February 2026

Newsletters

Weekly Market Update: 04 February 2026

Newsletters

Weekly Market Update: 28 January 2026

Insights

What Does Liquidity Mean in Crypto? A Beginner’s Guide

Liquidity in crypto measures how easily you can buy or sell assets without affecting prices. High liquidity means stable prices, reduced slippage, and faster trades—essential for smarter investing.

%20(1).jpg)

Insights

How to Build a Diversified Crypto Portfolio

Learn how to build a diversified crypto portfolio using proven strategies like the 50/30/20 model, dollar-cost averaging, and smart rebalancing to minimise risk, manage volatility, and maximise long-term gains.

Newsletters

Weekly Market Update: 21 January 2026

Newsletters

Weekly Market Update: 14 January 2026

Insights

The Best Crypto Brokers and Trading Platforms for 2026

Finding the right crypto broker is essential for avoiding scams and high fees. By choosing certified, compliant platforms that prioritise regulatory expertise, new traders can safely navigate market risks and reap the rewards of digital assets with confidence.

Newsletters

Weekly Market Update: 07 January 2026

Newsletters

Weekly Market Update: 24 December 2025

Newsletters

Weekly Market Update: 17 December 2025

Newsletters

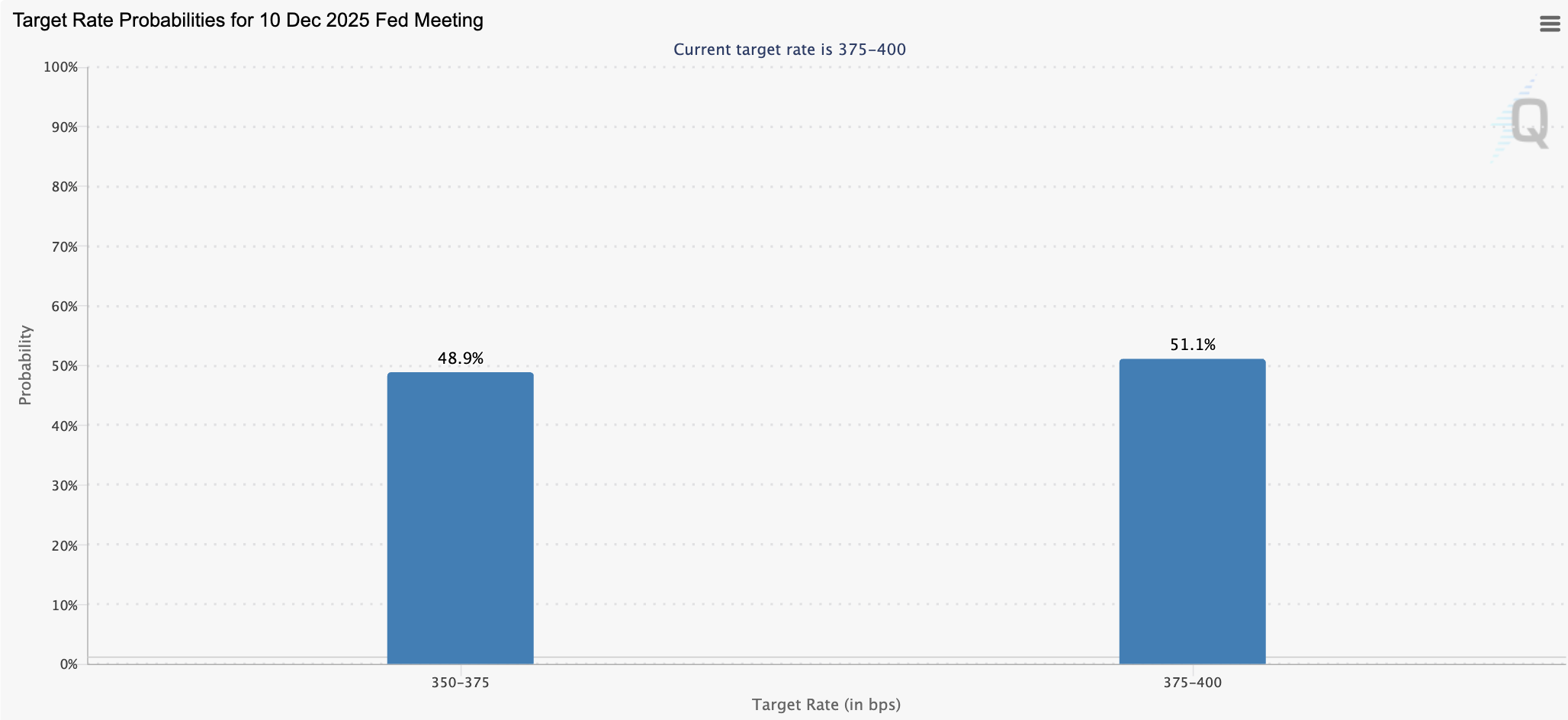

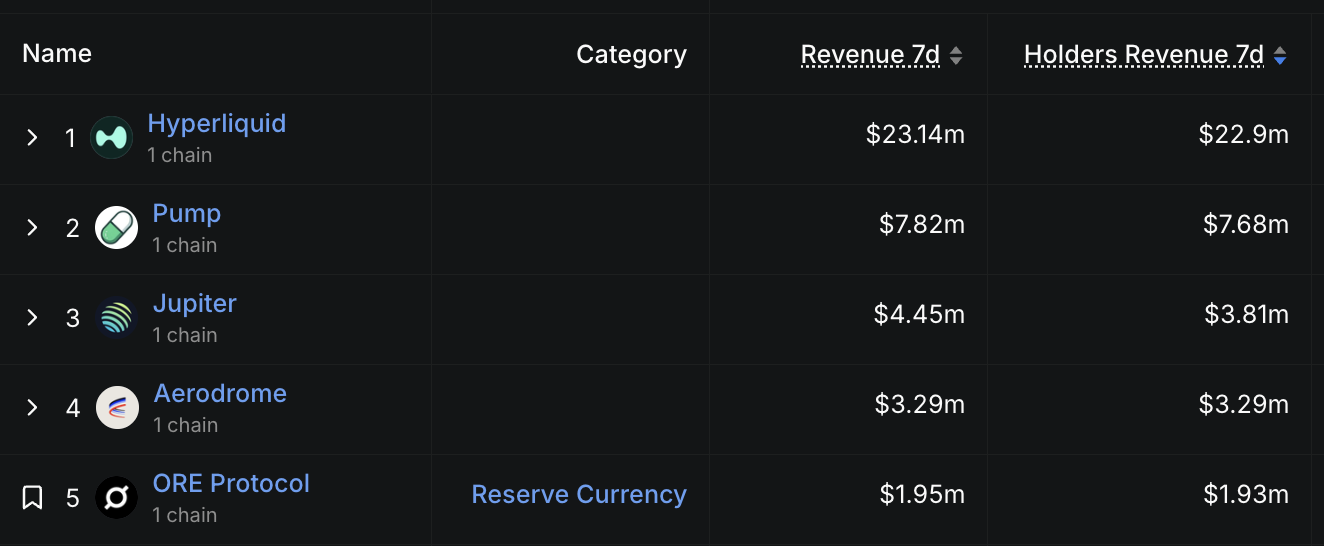

Weekly Market Update: 10 December 2025

Newsletters

Weekly Market Update: 3 December 2025

Newsletters

Weekly Market Update: 26 November 2025

Newsletters

Weekly Market Update: 19 November 2025

Newsletters

Weekly Market Update: 12 November 2025

.jpg)

Insights

SMSF Crypto Investing Australia: A Complete Guide

More Australians are adding crypto to their Self-Managed Super Funds (SMSFs) to diversify and take control of their retirement portfolios. This article outlines the benefits, risks, and compliance requirements of SMSF crypto investing — and how Uptrade helps trustees invest securely, transparently, and in full compliance with Australian regulations.

Newsletters

Weekly Report 5th Nov

Insights

DeFi Explained: How Decentralised Finance Is Changing Traditional Banking (Australia, 2025 Edition)

DeFi is transforming how money moves — replacing banks and intermediaries with transparent, code-based financial systems. This article explains how decentralised finance works, why it’s reshaping traditional banking, and how Australian investors can participate safely in the future of finance through regulated platforms, smart contracts, and on-chain innovation.

.jpg)

Insights

Our Guide to Meme Coins in 2026: How to Pick a Winner

Meme coins aren’t dead — they’re evolving. This article explores how community tokens, fair-launch models, and cross-chain innovation are reshaping meme culture in 2025. From Dogecoin to new Australian projects, it shows why memes still drive crypto adoption, liquidity, and creativity — even in a maturing market.

.jpg)

Insights

Smart Contract Hacks Australia: How Exploits Happen and How to Protect Your Crypto

Smart contracts power DeFi — but even one line of bad code can lead to multimillion-dollar losses. This article explains how hacks and exploits occur, why prevention is the only real protection, and what Australian investors can do to secure their crypto with audits, custody, and smarter on-chain habits.

.jpg)

Insights

Institutional Money in Crypto: How Big Investors Are Changing the Game

Institutional investors are reshaping crypto in 2025 — bringing stability, regulation, and long-term capital to the market. This article explores how ETFs, fund strategies, and macro liquidity cycles are changing volatility, extending bull markets, and turning crypto from a speculative trade into a recognised global asset class.

.jpg)

Insights

Crypto Outlook 2025: Has the Bull Market Been Interrupted or Just Reset?

After a volatile correction, many wonder if crypto’s bull market is over — or simply catching its breath. This article examines where we are in the 2025 cycle, how institutional money and liquidity shifts shape momentum, and why patience, not panic, could define the next major move for long-term investors.

.jpg)

Insights

How Crypto Is Changing the Way We Buy Luxury

From luxury watches to high-end cars, crypto is transforming how the wealthy shop. This article explores how digital currencies enable instant, borderless payments, reduce fraud, and attract a new generation of luxury buyers. Crypto isn’t just a payment method — it’s redefining trust, speed, and exclusivity in the global luxury market.

.jpg)

Insights

Real-World Assets (RWA): The Dominant Crypto Sector of 2025

Real-World Assets (RWAs) are redefining crypto in 2025 — turning real-world value like bonds and real estate into tokenised, tradable assets. This article explains how RWAs bridge traditional finance and DeFi, why institutions are backing them, and how they’re creating the most sustainable growth story in digital assets today.

.jpg)

Insights

Crypto Market Manipulation: How Liquidity Squeezes Shape the Market

Crypto markets don’t just react — they’re often engineered through liquidity squeezes and manipulation. This article explains how big players move markets, why retail traders get caught in the swings, and how to spot warning signs early. Understanding liquidity isn’t paranoia — it’s protection.

Newsletters

Weekly Market Update: 22 October 2025

Newsletters

Weekly Market Update: 8 October 2025

Newsletters

Weekly Market Update: 15 October 2025

.jpg)

Insights

Crypto Scams Australia: A Beginner’s Guide to Safe Investing

Crypto scams in Australia are rising. Learn how social engineering and staking traps work, and what to watch out for before investing.

Newsletters

Weekly Market Update: 1 October 2025

Newsletters

Weekly Market Update: 24 September 2025

Newsletters

Weekly Market Update: 17 September 2025

Newsletters

Weekly Market Update: 10 September 2025

Insights

Buying Cryptocurrency as a Company: Everything You Need to Know

Companies can buy and hold cryptocurrency as part of their treasury strategy, with growing adoption by major corporations. Benefits include diversification, future-proofing, new revenue streams, and tax advantages. However, businesses must navigate evolving regulations and compliance requirements, making professional brokers essential for secure, efficient entry into digital assets.

Insights

How to Buy and Sell Large Amounts of Cryptocurrency (Including Bitcoin, XRP, ETH) in 2026

Buying a small amount of crypto is relatively straightforward. However, buying and selling large amounts of cryptocurrency is an entirely different ball game. When we talk about large transactions, we’re faced with unique challenges around liquidity, security, regulation and price execution.

Newsletters

Weekly Market Update: 3 September 2025

Newsletters

Weekly Market Update: 27 August 2025

Newsletters

Weekly Market Update: 20 August 2025

Newsletters

Weekly Market Update: 13 August 2025

Newsletters

Weekly Market Update: 6 August 2025

Newsletters

Weekly Market Update: 30 July 2025

Newsletters

Weekly Market Update: 23 July 2025

Newsletters

Weekly Market Update: 16 July 2025

Newsletters

Weekly Market Update: 9 July 2025

Newsletters

Weekly Market Update: 2 July 2025

Newsletters

Weekly Market Update: 25 June 2025

Newsletters

Weekly Market Update: 18 June 2025

Newsletters

Weekly Market Update: 11 June 2025

Newsletters

Weekly Market Update: 4 June 2025

Newsletters

Weekly Market Update: 28 May 2025

Newsletters

Weekly Market Update: 21 May 2025

Newsletters

Weekly Market Update: 14 May 2025

Newsletters

Weekly Market Update: 7 May 2025

Newsletters

Weekly Market Update: 27 March 2024

Newsletters

Weekly Market Update: 3 April 2024

Newsletters

Weekly Market Update: 10 April 2024

Newsletters

Weekly Market Update: 17 April 2024

Newsletters

Weekly Market Update: 24 April 2024

Newsletters

Weekly Market Update: 1 May 2024

Newsletters

Weekly Market Update: 8 May 2024

Newsletters

Weekly Market Update: 15 May 2024

Newsletters

Weekly Market Update: 22 May 2024

Newsletters

Weekly Market Update: 29 May 2024

Newsletters

Weekly Market Update: 6 June 2024

Newsletters

Weekly Market Update: 12 June 2024

Newsletters

Weekly Market Update: 19 June 2024

Newsletters

Weekly Market Update: 26 June 2024

Newsletters

Weekly Market Update: 4 July 2024

Newsletters

Weekly Market Update: 10 July 2024

Newsletters

Weekly Market Update: 17 July 2024

Newsletters

Weekly Market Update: 24 July 2024

Newsletters

Weekly Market Update: 31 July 2024

Newsletters

Weekly Market Update: 8 August 2024

Newsletters

Weekly Market Update: 14 August 2024

Newsletters

Weekly Market Update: 21 August 2024

Newsletters

Weekly Market Update: 28 August 2024

Newsletters

Weekly Market Update: 4 September 2024

Newsletters

Weekly Market Update: 11 September 2024

Newsletters

Weekly Market Update: 18 September 2024

Newsletters

Weekly Market Update: 25 September 2024

Newsletters

Weekly Market Update: 2 October 2024

Newsletters

Weekly Market Update: 9 October 2024

Newsletters

Weekly Market Update: 16 October 2024

Newsletters

Weekly Market Update: 23 October 2024

Newsletters

Weekly Market Update: 30 October 2024

Newsletters

Weekly Market Update: 6 November 2024

Newsletters

Weekly Market Update: 13 November 2024

Newsletters

Weekly Market Update: 20 November 2024

Newsletters

Weekly Market Update: 27 November 2024

Newsletters

Weekly Market Update: 4 December 2024

Newsletters

Weekly Market Update: 11 December 2024

Newsletters

Weekly Market Update: 18 December 2024

Newsletters

Weekly Market Update: 30 April 2025

Newsletters

Weekly Market Update: 8 January 2025

Newsletters

Weekly Market Update: 15 January 2025

Newsletters

Weekly Market Update: 22 January 2025

Newsletters

Weekly Market Update: 23 April 2025

Newsletters